Splitting Profits

Investment Analysis | Splitting Profits

The IRR waterfall technique optimizes developers' payout potential.

by Jeffrey L. Engelstad, CCIM

Today's developers and their equity partners often opt for progressive strategies that shift downside risk away from the equity investor and provide greater upside potential for the developer. The internal rate of return waterfall technique is an increasingly popular method that accomplishes these goals.

Debt investors, equity investors, and developers always have jockeyed for position in splitting profits. The traditional structure represents an inverse hierarchy of risk and payment priority. The debt investor, or lender, has the first repayment priority and the lowest element of risk. In exchange, the lender accepts a predetermined return, namely the effective interest rate.

Next in line is the equity investor, who invests risk capital and is subject to a fluctuating return depending on the project's success. Finally, the developer, who also may be an equity investor, takes on the highest level of risk. While the developer's skill, tenacity, and vision often are critical to a project's success, the developer's return typically is subordinate to both the lender's and the equity investor's.

An IRR waterfall arrangement rectifies this situation by positively compensating the developer for a project well done, while at the same time minimizing downside risk for the equity investor. The concept is simple: If the returns are lower than expected, a greater proportion flows to the equity investor; if the returns are greater than expected, a larger share flows to the developer. Since the developer has the greatest influence on a project's success, the waterfall arrangement allocates risk and return in a more equitable fashion.

| Development Parameters | |

|---|---|

| Sale Price | $16,500,000 |

| Cost of Sale | $90,000 |

| Loan Repayment | $10,500,000 |

| Cash to Distribute | $5,910,000 |

| Equity Partner Capital | $3,500,000 |

| Developer Capital | $200,000 |

Table 1: Traditional Payout Agreement

| CFO | CF4 | IRR |

|---|---|---|

| $3,700,000 | $5,910,000 | 12.42% |

| Equity Partner | Developer | |

|---|---|---|

| Return of Capital | $3,500,000 | $200,000 |

| Preference Earned | $4,761,711 | $262,159 |

| Preferences Recieved | $4,761,711 | $262,159 |

| Split | $664,597 | $221,532 |

| Total | $5,426,308 | $483,692 |

| IRR | 11.59% | 24.71% |

Table 2: IRR Waterfall Payout Agreement

| CF0 | CF4 | IRR | Split | Equity Partner | Developer |

|---|---|---|---|---|---|

| $3,700,000 | $5,033,909 | 8.00% | 100/0 | $1,333,809 | $0 |

| $3,700,000 | $5,417,170 | 10.00% | 75/25 | $287,521 | $95,840 |

| $3,700,000 | $5,822,022 | 12.00% | 60/40 | $242,911 | $161,941 |

| $3,700,000 | $5,910,000 | 12.42% | 50/50 | $43,989 | $43,989 |

| Equity Partner | Developer | |

|---|---|---|

| Profit | $1,908,230 | $301,770 |

| Equity | $3,500,000 | $200,000 |

| Total | $5,408,230 | $501,770 |

| IRR | 11.49% | 25.85% |

Traditional vs. Waterfall Payout

The following example illustrates the differences between the two payout methods. Prior to development, the equity investor contributes $3.5 million and the developer contributes $200,000 in equity. After a four-year period of construction, lease up, and stabilization, the developed property sells for $16.5 million. Sales costs account for $90,000 and a $10.5 million loan balance is repaid at closing.

A traditional payout split gives the equity investor a preferred return of 8 percent and the developer a preferred return of 7 percent, and they agree to a net profit split of 75/25 percent. From this arrangement the investor receives $5,426,308 (11.59 percent IRR) and the developer receives $483,692 (24.71 percent IRR). (See Table 1: Traditional Payout Agreement.)

In contrast, the IRR waterfall agreement resembles a progressive commission split. The equity investor gets a higher percentage of the return at lower profit levels, but the developer gets a higher percentage at higher profit levels. For example, up to an 8 percent IRR, the investor gets 100 percent; from an 8.01 to 10 percent IRR, the investor receives 75 percent and the developer 25 percent. From 10.01 to 12 percent IRR, the split is 60/40 percent. Above 12 percent IRR, the split is 50/50 percent.

The split is determined based on a future value calculation of the total equity. For each split, the cash flow is a future value calculation based on the IRR waterfall agreement. Assuming the same sales price and profit as the traditional agreement, the investor would receive $5,408,230 at an 11.49 percent IRR and the developer would receive $501,770 — a 25.85 percent IRR. (See Table 2: IRR Waterfall Payout Agreement.)

Table 3: Lower Returns

| Lower Sales Price Parameters | |

|---|---|

| Sale Price | $16,200,000 |

| Costs of Sale | $90,000 |

| Loan Repayment | $10,500,000 |

| Cash to Distribute | $5,610,000 |

| Equity Partner Capital | $3,500,000 |

| Developer Capital | $200,000 |

Traditional Cash Flow T-Chart

| Equity Partner | Developer | Total | |

|---|---|---|---|

| CF0 | $3,500,000 | $200,000 | $3,700,000 |

| CF4 | $5,201,308 | $408,692 | $5,610,000 |

| IRR | 10.41% | 19.56% | 10.97% |

Waterfall Cash Flow T-Chart

| Equity Partner | Developer | Total | |

|---|---|---|---|

| CF0 | $3,500,000 | $200,000 | $3,700,000 |

| CF4 | $5,258,230 | $351,770 | $5,610,000 |

| IRR | 10.71% | 15.16% | 10.97% |

Table 4: Higher Returns

| Higher Sales Price Parameters | |

|---|---|

| Sale Price | $16,800,000 |

| Costs of Sale | $90,000 |

| Loan Repayment | $10,500,000 |

| Cash to Distribute | $6,210,000 |

| Equity Partner Capital | $3,500,000 |

| Developer Capital | $200,000 |

Traditional Cash Flow T-Chart

| Equity Partner | Developer | Total | |

|---|---|---|---|

| CF0 | $3,500,000 | $200,000 | $3,700,000 |

| CF4 | $5,651,308 | $558,692 | $6,210,000 |

| IRR | 12.72% | 29.28% | 13.82% |

Waterfall Cash Flow T-Chart

| Equity Partner | Developer | Total | |

|---|---|---|---|

| CF0 | $3,500,000 | $200,000 | $3,700,000 |

| CF4 | $5,558,230 | $651,770 | $6,210,000 |

| IRR | 12.26% | 34.36% | 13.82% |

Varying Returns

In this example using the expected selling price of $16.5 million, there is little difference between the traditional and the waterfall arrangements in regard to the returns to the equity investor and the developer. However, when the actual selling price varies significantly from the expected price, the differences are more dramatic.

Lower returns. Keeping all other parameters the same but using a selling price of $16.2 million instead of $16.5 million, the equity investor is protected marginally against downside risk at the developer's expense. While a traditional agreement would give the equity partner a 10.41 percent IRR and the developer a 19.56 percent IRR, the waterfall agreement raises the investor's return to 10.71 percent and lowers the developer's return to 15.16 percent. (See Table 3: Lower Returns.)

Higher returns. If the selling price is higher than expected, for example $16.8 million, then the developer's yield increases at a rapid pace when using the waterfall arrangement. Under the traditional agreement, the investor's IRR at a higher price is 12.72 percent and the developer's is 29.28 percent. But using the waterfall agreement, the investor's IRR falls slightly to 12.26 percent and the developer's IRR soars to 34.36 percent. (See Table 4: Higher Returns.)

Which Is Better?

Obviously, when the sales price is higher, the developer benefits more from the waterfall agreement. But the waterfall is a double-edged sword: As the actual price varies downward from the expected price, the developer loses profitability.

Depending on the particular negotiated arrangement, there typically is greater upside potential for the developer using a waterfall agreement, but there is a crossover point that represents the selling price where the traditional split and the waterfall arrangement yield the same result.

In this example, if the expected sales price is less than $16.4 million, then the developer is better off with the traditional split; however, if the sales price is expected to be greater than $16.4 million, the developer is better off with the waterfall arrangement. Should the eventual selling price far exceed expectations, the waterfall agreement compensates the developer in a nearly exponential fashion.

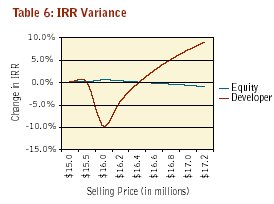

Comparing both the equity investor's and the developer's expected yield at varying selling prices under traditional and waterfall arrangements illustrates the crossover point of $16.4 million, as well as the fact that the waterfall agreement significantly boosts the developer's yield while maintaining very little variance for the equity investor. (See Table 5: Comparing Returns at Various Selling Prices.)

The developer's return is quite volatile as compared to the equity investor's return. (See Table 6: IRR Variance.) This volatility accurately portrays the additional risk born by the developer and adequately provides for positive compensation when the project turns out better than expected.

A Negotiating Tool

Negotiating the IRR waterfall agreement is critical to the relative success of the equity investor and the developer. The crossover point, or sales price projection, should be the point of reasonable expectation. If this point is set too high, the developer suffers; if it is set too low, the equity investor suffers.

Understanding the technique allows CCIMs to better advise their clients when making preference and profit split agreements. For developers who believe they can add value to a project, the idea of accepting more downside risk in exchange for additional upside potential may be particularly appealing.